Vulnerabilities associated with the indebtedness of some euro-area sovereigns and banks have resulted in severe strains in bank funding markets and financial markets more generally. These tensions in the world economy threaten the UK recovery."

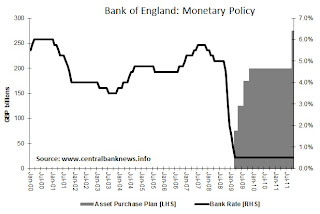

The Bank also held the official Bank Rate unchanged at 0.50% at its August meeting this year; the rate has remained on hold since March 2009, when the Bank reduced the interest rate by 50 basis points to 0.50%. The United Kingdom reported annual consumer price inflation of 4.5% in August, and 4.4% in July, and still above the Bank's inflation target of 2.00%. The UK saw quarterly GDP growth of 0.2% in Q2 this year (0.5% in Q1), while annual economic growth was reported at 0.7% (1.6% previously).

The pound (GBP) last traded around 0.65 against the US dollar, putting it about flat against the US dollar so far this year. The Bank also noted in regards to its quantitative easing program: "A programme of asset purchases financed by the issuance of central bank reserves was initiated on 5 March 2009. The previous change in the size of that programme was an increase of £25 billion to a total of £200 billion on 5 November 2009."

0 comments:

Post a Comment