The Reserve Bank of Australia (RBA) cut the cash rate by 25 basis points to 4.50% from 4.75% previously. The RBA said: "Over the past year, the Board has maintained a mildly restrictive stance of monetary policy, in view of its concerns about inflation. With overall growth moderate, inflation now likely to be close to target and confidence subdued outside the resources sector, the Board concluded that a more neutral stance of monetary policy would now be consistent with achieving sustainable growth and 2–3 per cent inflation over time."

CentralBankNews.info - A trusted and authoritative source on global monetary policy

Monday, October 31, 2011

Sunday, October 30, 2011

Central Bank of Trinidad & Tobago Holds Rate at 3.00%

The Central Bank of Trinidad & Tobago held its repo rate unchanged at 3.00%. The Bank said: "With inflationary pressures remaining well contained so far and credit conditions improving, the Bank views the present accommodative stance to be appropriate and has decided to maintain the repo rate at 3.00 percent." The Bank also commented: "credit conditions have continued to improve steadily although economic activity particularly in the non-energy sector is still quite lethargic."

Saturday, October 29, 2011

Monetary Policy Week in Review - 30 Oct 2011

The past week in monetary policy saw 15 central banks announce interest rate decisions. Those that increased interest rates were: India +25bps to 8.50%, and Mongolia +50bps to 12.25%, while those that decreased interest rates were: The Gambia -100bps to 14.00%, Sierra Leone -300bps to 20.00%, and Georgia -25bps to 7.25%. Also announced was Angola's central bank setting its new benchmark interest rate at 10.50%. The central banks that held interest rates unchanged were: Israel 3.00%, Canada 1.00%, Hungary 6.00%, New Zealand 2.50%, Japan 0-0.10%, Russia 8.25%, Namibia 6.00%, Sweden 2.00%, and Colombia 4.50%. Also in the news was the Bank of Japan announcing a 5 trillion yen addition to its quantitative easing program.

Angola Central Bank Sets New Benchmark Rate at 10.50%

The Banco Nacional de Angola (BNA) set its new benchmark interest rate at 10.5%. The BNA said: "Considering the performance of economic activity at the national level, financial indicators should be monitored with caution so that the money supply remains at appropriate levels". Earlier in the month the Bank was reported as delaying the introduction of the average interbank lending rate (the Luibor) until November. The Bank will next review the benchmark interest rate on the 28th of November.

Friday, October 28, 2011

Sierra Leone Central Bank Cuts Rate 300bps to 20.00%

The Bank of Sierra Leone cut its monetary policy rate by 300 basis points to 20.00% from 23.00% previously; also changing the Reverse Repo Rate to 22.00%, Rediscount Rate to 24.00%, and Standing Facility Rate at 27%. The Bank said: "The MPC discussed the appropriateness of the Bank's monetary policy stance in light of observed tight liquidity in the money market. It noted that with the growth of Reserve Money within its 2011 program target and inflation trending downwards, the Bank has some leeway to ease the tight liquidity condition in the money market. The MPC also noted the efforts being made by the fiscal authorities in public expenditure management to support the Bank's monetary policy."

National Bank of Georgia Cuts Rate 25bps to 7.25%

The National Bank of Georgia cut its benchmark refinancing interest rate by 25 basis points to 7.25% from 7.50%. The Bank said: "The annual inflation rate dropped below the target level of the NBG in September and is expected to decrease further at the beginning of the next year. According to the existing forecasts, the inflation forecast in 2012 will remain below the target level. Accordingly, the Monetary Policy Committee of the NBG considered it appropriate to continue easing the monetary policy and decided to decrease the policy rate by 25 basis points."

Bank of Mongolia Hikes Interest Rate 50bps to 12.25%

The Bank of Mongolia increased its policy rate by 50 basis points to 12.25% from 11.75% previously. The Bank said: "The rapid expansion of budget expense, cash hand-out from the Human Development Fund and the high increase in loans are contributing to higher demand. This sharp increase in demand builds the pressure on core inflation even the total supply and the real capacity of economy have not added on yet. The consecutive growth in prices of non-food products from the beginning of 2011 and the current stand in yoy 11.3% prove that the increase of total demand is bringing the growth of core price."

Central Bank of Colombia Holds Benchmark Rate at 4.50%

The Central Bank of Colombia held its benchmark monetary policy interest rate unchanged at 4.50%. The Bank said [translated]: "Given the global financial and economic risks and their potential effect on the Colombian economy, the Board considers it prudent to keep interest rate unchanged for intervention. However, if international confidence tends to be restored and if the internal real indicators continue with the current dynamism and no significant further spread of the external situation, it is likely that the economy requires less monetary stimulus. Latter in order to maximize the sustained growth of output and employment."

Sweden Central Bank Holds Interest Rate at 2.00%

Sweden's Riksbank held its benchmark repo rate unchanged at 2.00%. The Bank said: "The difficulties in resolving the public finance crisis in Europe has led to increased uncertainty regarding the future. In Sweden, growth is expected to be slightly weaker in the coming period. At the same time, inflationary pressure is low. The Executive Board of the Riksbank has therefore decided to hold the repo rate unchanged at 2 per cent and to wait to increase it until sometime next year."

Bank of Namibia Keeps Interest Rate at 6.00%

The Bank of Namibia kept its benchmark interest rate, the repurchase rate, unchanged at 6.00%, for the 5th consecutive meeting. Bank of Namibia Governor Ipumbu Shiimi said: "With the opportunity provided by the benign inflation outlook, the MPC decided to keep the repo rate unchanged at 6.0 percent to support domestic growth in the face of the prevailing global uncertainty,"

Central Bank of Russia Maintains Refinancing Rate at 8.25%

The Central Bank of Russia held its benchmark refinancing rate steady at 8.25%, and the overnight auction-based repurchase rate at 5.25% and the fixed overnight deposit rate at 3.75%. The Bank said: "Considering recent domestic and international macroeconomic developments and the effect of the monetary policy measures, implemented in recent months, the Bank of Russia judged that the current level of money market interest rates is appropriate to balance the inflationary risks and the risks of economic growth slowdown in the nearest future"

Central Bank of The Gambia Cut Rate 100bps to 14.00%

The Central Bank of The Gambia reduced its rediscount rate by 100 basis points to 14.00% from 15.00% previously, and left the reserve requirement ratio unchanged at 12%. The Bank said: "Owing to strong growth in the emerging economies, commodity prices remain at elevated levels. This coupled with persistent excess demand in the major emerging market economies are contributing to broader global inflationary pressures." Also noting the Gambian "economy is expected to benefit from increased value – added of agriculture and tourism."

Thursday, October 27, 2011

Japan Adds 5 trillion to Quantitative Easing Program

The Bank of Japan announced an expansion of its Asset Purchase Program (quantitative easing) of 5 trillion yen, to a new total of 55 trillion yen; with the increase designated for purchase of Japanese government bonds (JGBs). The Bank said: "some more time will be needed to confirm that price stability is in sight and due attention is needed for the risk that the economic and price outlook will further deteriorate depending on developments in global financial markets and overseas economies. While steadily implementing its decision in August to enhance monetary easing, especially through the purchase of financial assets, the Bank deemed it necessary to further enhance monetary easing so as to ensure a successful transition to a sustainable growth path with price stability."

RBNZ Keeps Cash Rate on Hold at 2.50%

The Reserve Bank of New Zealand kept the Official Cash Rate (OCR) on hold at 2.50%, noting the impact of global developments. The Bank Said: ""Given the ongoing global economic and financial risks, it remains prudent to continue to keep the OCR on hold at 2.5 percent for now. However, if global developments have only a mild impact on the New Zealand economy, it is likely that gradually increasing pressure on domestic resources will require future OCR increases."

Wednesday, October 26, 2011

Hungary Central Bank Keeps Interest Rate at 6.00%

The Magyar Nemzeti Bank kept its central bank base rate unchanged at 6.00%. The Bank said: "In the Council's judgement, the outlook for growth has worsened significantly recently. Consumption demand is likely to be persistently low, reflecting the protracted process of balance sheet adjustment by households, uncertain income prospects and the further tightening in credit conditions. Significant fiscal adjustment next year is also likely to act as a brake on domestic demand growth."

The Magyar Nemzeti Bank kept its central bank base rate unchanged at 6.00%. The Bank said: "In the Council's judgement, the outlook for growth has worsened significantly recently. Consumption demand is likely to be persistently low, reflecting the protracted process of balance sheet adjustment by households, uncertain income prospects and the further tightening in credit conditions. Significant fiscal adjustment next year is also likely to act as a brake on domestic demand growth."Bank of Tanzania Raises Repo Auction Rate

The Bank of Tanzania increased its repurchase agreement (repo) interest rate, placing the weighted average rate into double digits, with the rate last printing at 11.59% at the 25th of October auction (which compares to 8.24% at the start of the year, and a low of 0.93%). Tanzania reported inflation of 16.8% in September, compared to 10.9% in June.

Tuesday, October 25, 2011

Bank of Canada Keeps Interest Rate at 1.00%

The Bank of Canada kept its target for the overnight rate unchanged at 1.00%; also holding the Bank Rate at 1.25% and the deposit rate at 0.75%. The Bank noted: "The global economy has slowed markedly as several downside risks to the projection outlined in the Bank's July Monetary Policy Report (MPR) have been realized. Financial market volatility has increased and there has been a generalized retrenchment from risk-taking across global markets. The combination of ongoing deleveraging by banks and households, increased fiscal austerity and declining business and consumer confidence is expected to restrain growth across the advanced economies. The Bank now expects that the euro area—where these dynamics are most acute—will experience a brief recession."

Reserve Bank of India Hikes Rate 25bps to 8.50%

The Reserve Bank of India [RBI] raised its repo rate by 25 basis points to 8.50% from 8.25% and raised the reverse repo rate to 7.50% from 7.25%. The RBI said: "both inflation and inflation expectations remain high. Inflation is broad-based, and is above the comfort level of the Reserve Bank. We expect these levels to persist for two more months. There are potential risks of expectations becoming unhinged in the event of a pre-mature change in the policy stance. However, reassuringly, momentum indicators, particularly the de-seasonalised quarter-on-quarter headline and core inflation measures, indicate moderation. This is consistent with the projection that inflation will decline beginning December 2011."

Monday, October 24, 2011

Bank of Israel Keeps Interest Rate at 3.00%

The Bank of Israel held its benchmark interest unchanged at 3.00%. The Bank said: "The decision to leave the interest rate for November unchanged after reducing it for October is in line with monetary policy aimed at stabilizing the rate of inflation within the price stability target range of 1–3 percent over the coming 12 months, and is intended to support growth while preserving financial stability. The path of the interest rate in the future depends on developments in the inflation environment, growth in Israel, the global economy, the monetary policies of major central banks, and developments in the exchange rate of the shekel."

Friday, October 21, 2011

Monetary Policy Week in Review - 22 Oct 2011

The past week in monetary policy saw interest rate decisions announced by 7 central banks. The only bank to announce a change to its main monetary policy interest rate was the Banco Central do Brasil, which cut its interest rate by another 50 basis points to 11.50%. Meanwhile the other central banks held their key interest rates unchanged: Botswana 9.50%, Norway 2.25%, Thailand 3.50%, Ghana 12.50%, Philippines 4.50%, and Turkey 5.75%. A common theme mentioned by the central bankers was concern over signs of slowing global growth and the potential risks arising from the ongoing sovereign debt crisis in Europe.

Turkey Central Bank Holds Repo Rate at 5.75%

The Central Bank of the Republic of Turkey held its benchmark 1-week repo rate at 5.75%. The Bank said: "Recent data releases suggest that there will be a notable reduction in economic growth in the second half of the year. External demand remains weak, and domestic demand continues to slow down. The deceleration in credit growth and domestic demand combined with the exchange rate movements have been contributing to the rebalancing of domestic and external demand. Accordingly, the Committee expects a significant improvement in the current account balance in the forthcoming period."

Thursday, October 20, 2011

Philippines Central Bank Keeps Policy Rate at 4.50%

The Bangko Sentral ng Pilipinas kept its overnight borrowing rate unchanged at 4.50% and the overnight lending rate at 6.50%, and kept reserve requirements unchanged at 21%. The Bank said: "The Monetary Board's assessment of a manageable inflation environment and subdued economic conditions continues to support current monetary policy settings. Latest average baseline forecasts show a lower inflation path, consistent with the 3-5 percent target range for 2011-2013, while inflation expectations remain well-contained, supported by easing commodity prices. Domestic economic growth has moderated as the global recovery has slowed down and as domestic public spending has been weaker than expected."

Bank of Ghana Keeps Lending Rate at 12.50%

The Bank of Ghana kept its key lending rate steady at 12.50%. Bank of Ghana Governor, Kwesi Amissah-Arthur, said: "Looking ahead, wage pressures, payment arrears and recent depreciation of the exchange rate have increased the upside risks to inflation. In the short-term, the impact of these underlying inflationary pressures on the economy remains contained. The Bank's inflation forecasts show that the end year target will be achieved. Movements in the exchange rate remain consistent with the delivery of the Bank's inflation target."

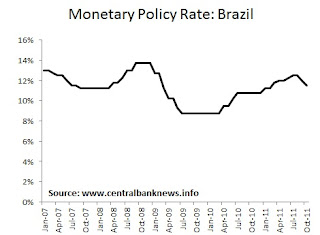

Brazil Central Bank Cuts Rate Another 50bps to 11.50%

The Banco Central Do Brasil dropped the Selic interest rate by another 50 basis points to 11.50% from 12.00% previously. In its statement, Brazil's Central Bank Monetary Policy Committee (Copom) said [translated]: "Continuing the process of adjusting monetary conditions, the Committee decided unanimously to reduce the Selic rate to 11.50% pa, without bias. The Monetary Policy Committee believes that the timely mitigate the effects coming from a more restrictive global environment, a moderate adjustment in the level of the base rate is consistent with the scenario of convergence of inflation to the target in 2012."

The Banco Central Do Brasil dropped the Selic interest rate by another 50 basis points to 11.50% from 12.00% previously. In its statement, Brazil's Central Bank Monetary Policy Committee (Copom) said [translated]: "Continuing the process of adjusting monetary conditions, the Committee decided unanimously to reduce the Selic rate to 11.50% pa, without bias. The Monetary Policy Committee believes that the timely mitigate the effects coming from a more restrictive global environment, a moderate adjustment in the level of the base rate is consistent with the scenario of convergence of inflation to the target in 2012."Bank of Thailand Keeps Rate at 3.50%

The Bank of Thailand held its benchmark 1-day bond repurchase rate unchanged at 3.50%. Bank of Thailand Assistant Governor, Mr. Paiboon Kittisrikangwan, said: "The MPC deemed that the current level of the policy rate is appropriate in addressing upcoming inflationary pressure and supporting economic adjustments amidst heightened uncertainty in the global economy. Meanwhile, with the floods not yet over, their impact on the economy was not fully evident. The MPC therefore voted 6 to 1 to hold the policy interest rate at the current level of 3.50 per cent, with one vote in favour of a 0.25 per cent decrease. The MPC would remain vigilant in monitoring developments of risks and stand ready to take appropriate policy actions."

The Bank of Thailand held its benchmark 1-day bond repurchase rate unchanged at 3.50%. Bank of Thailand Assistant Governor, Mr. Paiboon Kittisrikangwan, said: "The MPC deemed that the current level of the policy rate is appropriate in addressing upcoming inflationary pressure and supporting economic adjustments amidst heightened uncertainty in the global economy. Meanwhile, with the floods not yet over, their impact on the economy was not fully evident. The MPC therefore voted 6 to 1 to hold the policy interest rate at the current level of 3.50 per cent, with one vote in favour of a 0.25 per cent decrease. The MPC would remain vigilant in monitoring developments of risks and stand ready to take appropriate policy actions."Norwegian Central Bank Holds Rate at 2.25%

Norway's central bank, Norges Bank, held its key monetary policy rate steady at 2.25%, and signaled no changes. The Bank's Deputy Governor, Jan F. Qvigstad, said: "The Executive Board is of the view that the outlook and the balance of risks now suggest that the key policy rate should be kept at the current level for some time ahead. If the economic unrest abroad intensifies, money market premiums remain high and the outlook for growth and inflation weakens further, the key rate may be reduced. If financial market turbulence subsides and there are prospects of higher growth and inflation, the key rate may rise."

Tuesday, October 18, 2011

Bank of Botswana Holds Bank Rate at 9.50%

The Bank of Botswana's Monetary Policy Committee held the benchmark interest rate unchanged at 9.50%. The Bank said: "While short-term price developments have resulted in inflation remaining above the objective range of 3 - 6 percent, the medium-term outlook for consumer prices is more encouraging. As a result, the Committee judged that maintaining the Bank Rate at the current level is consistent with inflation converging on the objective range in the medium term."

Friday, October 14, 2011

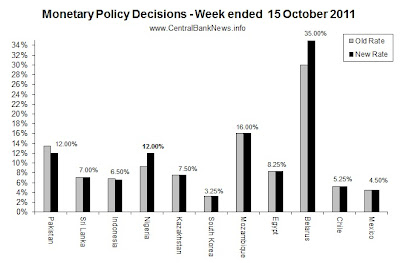

Monetary Policy Week in Review - 15 October 2011

The past week in monetary policy featured monetary policy decisions from 12 central banks around the world. Those that increased interest rates were: Nigeria +275bps to 12.00% and Belarus +500bps to 35.00%. Meanwhile those that reduced interest rates were: Pakistan -150bps to 12.00%, and Indonesia -25bps to 6.50%. Those that held interest rates unchanged included: Sri Lanka 7.00%, Kazakhstan 7.50%, South Korea 3.25%, Mozambique 16.00%, Egypt 8.25%, Chile 5.25%, and Mexico 4.50%. The Monetary Authority of Singapore also eased monetary policy settings, noting that it would continue with a policy of modest and gradual appreciation of its currency.

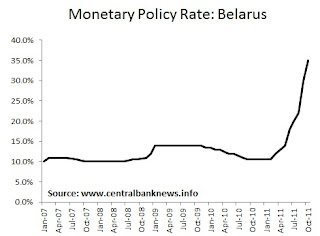

Belarus Central Bank Lifts Rate 500bps to 35.00%

The National Bank of the Republic of Belarus raised its refinancing rate by 500 basis points to 35.00% from 30.00%. The Bank said [translated]: "The move is next step in the consistent implementation of the general economic policy of the National Bank and the Government aimed at macroeconomic stabilization, reducing the pressure on the Belarusian ruble exchange rate and reducing inflation. The National Bank jointly with the Government of the Republic of Belarus will continue the adoption of stabilization measures in the light of internal and external economic developments."

Banco de Mexico Keeps Interest Rate at 4.50%

The Banco de Mexico held its overnight interest rate target steady at 4.50%. In its monetary policy statement the Bank noted: "the current monetary policy posture is conducive to achieve the 3.0% inflation objective." Further commenting: "However, we will remain alert to the prospects for world economic growth and its possible implications for the Mexican economy, which, in the context of great monetary slack in the principal advanced economies could as a result make it appropriate to relax monetary policy."

Banco Central de Chile Keeps Interest Rate at 5.25%

The Banco Central de Chile kept its monetary policy interest rate steady at 5.25%. The Bank noted: "Domestically, output and demand show signs of moderation. In the case of output, the slowdown is more pronounced than was assumed in the Monetary Policy Report's baseline scenario; the opposite occurs with demand. Labor market conditions remain tight. CPI inflation rates have hovered around 3% y-o-y, while core inflation measures remain contained. Inflation expectations are close to the target. "

Monetary Authority of Singapore Eases Policy

The Monetary Authority of Singapore eased monetary policy settings. The MAS said: "Given the stresses and fragility in the advanced economies, the prospects for growth in Singapore's major trading partners have deteriorated. With the slowdown in demand, growth in the Singapore economy could fall below its potential rate of 3-5%. Thus, core inflation should ease next year, although headline inflation could stay elevated in the near term reflecting the higher imputed rental cost of owner-occupied housing. MAS will continue with the policy of a modest and gradual appreciation of the S$NEER policy band in the period ahead. However, given the expected moderation in core inflation, the slope of the policy band will be reduced, with no change to the width of the band and the level at which it is centred."

Central Bank of Egypt Keeps Monetary Policy Unchanged

The Central Bank of Egypt held its overnight deposit rate unchanged at 8.25%, the overnight lending rate at 9.75%. The Bank said: "the slowdown in economic growth should limit upside risks to the inflation outlook. Given the balance of risks on the inflation and GDP outlooks and the increased uncertainty at this juncture, the MPC judges that the current key CBE rates are appropriate." On the inflation outlook the bank noted: "The probability of a rebound in international food prices is less likely now in light of recent global developments, nonetheless supply shortages in certain food commodities on the back of bad harvests could pose an upside risk to the inflation outlook."

Thursday, October 13, 2011

Bank of Mozambique Holds Lending Rate at 16.00%

The Bank of Mozambique kept its standing facility lending interest rate at 16.00%. The Bank said [translated]: "the main economic indicators evolve positively, in line with plans for this year, highlighting the components of the external sector and inflation projections, short and medium term; although risks remain to be taken into account. It is essential in this time of year to enhance coordination of policies aimed at consolidating macroeconomic stability and recommended both to the private sector and the economic agents in general, in a framework of exchange rate stability in the country, to ensure the timely supply to market of commodities.

South Korea Central Bank Holds Rate at 3.25%

The Bank of Korea maintained its 7-day repurchase rate unchanged at 3.25%. The Bank said: "Based on currently available information, the Committee considers that, while emerging market economies have shown favorable performances, major advanced economies have exhibited signs of sluggishness. Going forward the Committee forecasts that the global economy will show a recovery, albeit a moderate one; nevertheless, the Committee judges that downside risks to growth have expanded."

Wednesday, October 12, 2011

National Bank of Kazakhstan Holds Refinancing Rate at 7.50%

The National Bank of Kazakhstan held its key refinancing rate unchanged at 7.50% as inflationary pressures ease somewhat. NBK Chairman, Grigori Marchenko, said that the central bank will not revise its 2011 inflation target of 6-8%, after the "lower-than-expected" inflation reading in September. The Market does not expect any interest rate changes in the near term. Kazakhstan's central bank last increased the interest rate in March this year by 50 basis points to 7.50%.

Tuesday, October 11, 2011

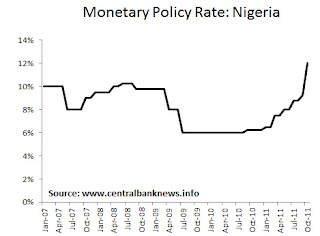

Central Bank of Nigeria Hikes Rate 275bps to 12.00%

The Central Bank of Nigeria hiked its monetary policy interest rate by 275 basis points to 12.00% from 9.25%, after convening an emergency meeting as a result of heightened global uncertainty and a desire to preserve the value of its currency, the Naira. The Bank also voted to raise the cash reserve ratio to 8% from 4% previously.

The Central Bank of Nigeria hiked its monetary policy interest rate by 275 basis points to 12.00% from 9.25%, after convening an emergency meeting as a result of heightened global uncertainty and a desire to preserve the value of its currency, the Naira. The Bank also voted to raise the cash reserve ratio to 8% from 4% previously. Bank Governor, Lamido Sanusi, said: "The global economic horizon remains highly uncertain, with the signs getting more ominous as policy makers find it increasingly difficult to take the necessary economic decisions that may avert a new wave of recession."

"Three self-reinforcing negatives continue to define the global economy: the sovereign debt crisis in the Eurozone, significant undercapitalization of internationally-active banks, and negative market sentiment leading to continuing flight to cash as a safe haven and deleveraging. The first and second aspects intensify the third, and without confidence and some appetite for financial assets and credit, the debt crisis and financial solvency concerns in turn become deeper"

Bank Indonesia Cuts Interest Rate 25bps to 6.50%

Indonesia's central bank, Bank Indonesia, dropped the BI reference rate 25 basis points to 6.50% from 6.75%. Bank Indonesia Governor, Darmin Nasution, said: "We are bringing the policy rate to a level that is more reasonable," further noting "we saw the 6.75 percent rate as too high, unless we estimated inflation next year to be very high." Nasution also noted the impact of global conditions; "The global crisis has not hit our real sector except for the financial market," and pointed out that "Private consumption and investment remain the driver in economic growth."

Monday, October 10, 2011

Central Bank of Sri Lanka Maintains Interest Rate at 7.00%

The Central Bank of Sri Lanka left its benchmark repurchase rate unchanged at 7.00%, and also kept the reverse repurchase rate at 8.50%, and the Statutory Reserve Ratio at 8%. The Bank said: "Inflation on a year-on-year basis is expected to continue to moderate during the remainder of 2011, with the continuous improvements in domestic supply conditions supported by the high growth momentum of the economy as well as the expected moderation of international commodity prices." The Bank also noted "the growth of money supply is expected to moderate in the period ahead given the decline in excess liquidity in the money market"

Saturday, October 8, 2011

State Bank of Pakistan Cuts Rate 150bps to 12.00%

The State Bank of Pakistan unexpectedly slashed its discount rate 150 basis points to 12.00% from 13.50%. The Bank said: "There is a decline in CPI inflation and government borrowing from SBP is lower than its end-June level. Led by consistent inflow of workers' remittances the external current account position is comfortable though there has been some decline in SBP's foreign exchange reserves. Importantly, concerns regarding weak private sector credit growth and falling real private investment expenditures remain along with a likelihood of rise in real interest rates."

Friday, October 7, 2011

Monetary Policy Week in Review - 8 October 2011

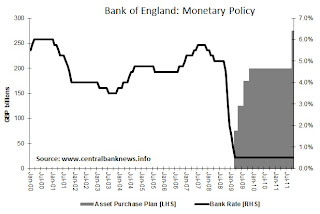

The past week in monetary policy saw 12 central banks reviewing monetary policy settings, with 6 adjusting interest rates. Those that changed interest rates were: Albania -25bps to 5.00%, Uganda +400bps to 20.00%, Kenya +400bps to 11.00%, Vietnam +100bps to 15.00%, Serbia -50bps to 10.75%, and Rwanda +50bps to 6.50%. Those that held rates unchanged were: Australia 4.75%, Poland 4.50%, UK 0.50%, EU 1.50%, Peru 4.25%, and Japan 0.10%. Also making news in monetary policy was the announcement from the Bank of England that it would add a further GBP 75 billion to its Asset Purchase Program (quantitative easing). Similarly the ECB announced a set of liquidity and asset buying measures in its monetary policy announcement.

Rwanda Central Bank Lifts Rate 50bps to 6.50%

The National Bank of Rwanda raised its key repo rate 50bps to 6.50% from 6.00% previously, with the interbank interest rate corridor changing to 4.50-8.50% and the discount rate now 10.50%. Bank Governor, Claver Gatete, said: "the real economic growth in Rwanda is likely to exceed the 7 percent initially projected for the year 2011. It is expected to reach 8.8 percent whereas the inflation forecast is at 8.2 percent by end December 2011. Considering these projections, the Central Bank finds it appropriate to review its policy rate in order to keep the monetary aggregates at optimal levels to limit inflation pressures while continuing to support economic growth."

National Bank of Serbia Cuts a Further 50bps to 10.75%

The National Bank of Serbia cut its 2-week repo rate by another 50 basis points to 10.75% from 11.25% previously. The Bank said: "The Executive Board expects that inflation will continue to decline and that it will enter the target tolerance band in the first half of the next year. The future path of the key policy rate will depend on the achievement of projected inflation, and on the materialisation of risks, primarily those stemming from the international environment and fiscal policy at home."

Bank of Japan Monetary Policy Unchanged, Rate at 0-0.10%

The Bank of Japan held its uncollateralized overnight call rate unchanged at a range of 0 to 0.1% by a unanimous vote. The Bank said "Japan's economic activity has continued picking up. Production and exports have continued to increase, although their paces have moderated after going through the recovery phase immediately following the quake-induced plunge... business fixed investment has been increasing moderately, and private consumption has been picking up on the whole."

State Bank of Vietnam Raises Rate 100bps to 15.00%

The State Bank of Vietnam (SBV) increased the refinancing rate 100 basis points to 15.00% from 14.00% previously. The overnight rate for interbank clearing operations also increase to 16% from 14%, and the rate on excess foreign currency reserves reduces to 0.05% from 0.1%. The SBV said: "The adjustment of the above-mentioned interest rates mainly aims at ensuring the proper relationship between the SBV's benchmark rates and SBV's role as the last resort lender in order to improve the efficiency of monetary policy and market management."

Central Reserve Bank of Peru Keeps Rate at 4.25%

The Central Reserve Bank of Peru kept its monetary policy reference rate unchanged at 4.25%. The Bank said: "This decision takes into account the slowdown observed in some components of expenditure and production, as well as the intensification of international financial risks. Should these trends continue, the Central Bank will change its monetary policy stance. "

Thursday, October 6, 2011

European Central Bank Keeps Interest Rate at 1.50%

The European Central Bank (ECB) maintained the Main refinancing operations rate unchanged at 1.50%, the Marginal lending facility at 2.25% and Deposit facility at 0.75%. The Bank said "Inflation has remained elevated and incoming information has confirmed our view that inflation is likely to stay above 2% over the months ahead but to decline thereafter. At the same time, the underlying pace of monetary expansion continues to be moderate. Ongoing tensions in financial markets and unfavourable effects on financing conditions are likely to dampen the pace of economic growth in the euro area in the second half of this year."

Bank of England Adds 75 billion to Quantitative Easing Program

The Bank of England (BoE) held the Bank Rate at a record low stimulatory level of 0.50%. However the BoE did announce a 75 billion pound expansion of its 200 billion pound asset purchase program (also known as quantitative easing), taking the new total to GBP 275 billion. The Bank said: "The pace of global expansion has slackened, especially in the United Kingdom's main export markets.

Vulnerabilities associated with the indebtedness of some euro-area sovereigns and banks have resulted in severe strains in bank funding markets and financial markets more generally. These tensions in the world economy threaten the UK recovery."

Vulnerabilities associated with the indebtedness of some euro-area sovereigns and banks have resulted in severe strains in bank funding markets and financial markets more generally. These tensions in the world economy threaten the UK recovery."

Wednesday, October 5, 2011

Central Bank of Kenya Ups Rate 400bps to 11.00%

The Central Bank of Kenya upped its benchmark lending rate by 400 basis points to 11.00% from 7.00% previously. The central bank Governor, Njuguna Ndung'u, said: "The Committee decided to raise the CBR by 400 basis points to 11.0 percent. In addition, the MPC will be meeting every first week of the month until further notice," and said the CBK "will revise the CBR further if inflation and exchange rate volatility do not abate." also noting: "inflationary pressure has continued to increase and both the weakening of the shilling and its volatility poses additional threats."

National Bank of Poland Keeps Rate at 4.50%

The Narodowy Bank Polski's Monetary Policy Council kept the benchmark 7-day interest rate unchanged at 4.50%. The Bank said: "In the medium term, inflation will be curbed by the anticipated decline in domestic economic growth amidst fiscal tightening, including reduced public investment spending, and interest rate increases implemented in the first half of 2011, as well as a likely global economic slowdown. On the other hand, the impact of the situation in the global financial markets on the zloty exchange rate constitutes an upside risk factor to domestic price developments."

Bank of Uganda Ups Rate 400bps to 20.00%

The Bank of Uganda hiked its new monetary policy interest rate (the central bank rate [CBR]) by 400 basis points to 20.00% from 16.00% previously. The Bank also raised the rediscount rate to 25.00% and the Bank Rate to 26.00%, by the same margin. Bank of Uganda Governor, Emmanuel Tumusiime-Mutebile, said: "This should be seen as a clear signal to bring inflation under control," signalling a hard-line against Uganda's double digit inflation; "However, should the upside risk to inflation continue in the months ahead, then monetary policy will be tightened further."

Tuesday, October 4, 2011

Reserve Bank of Australia Keeps Rate at 4.75%

The Reserve Bank of Australia (RBA) kept the cash rate unchanged at 4.75%. The RBA said: "Taking into account all the recent information, the path for inflation may now be more consistent with the 2–3 per cent target in 2012 and 2013, abstracting from the impact of the carbon pricing scheme. This assessment will be reviewed on receipt of further data on prices ahead of the Board's next meeting. An improved inflation outlook would increase the scope for monetary policy to provide some support to demand, should that prove necessary."

Monday, October 3, 2011

Bank of Albania Cuts Rate 25bps to 5.00%

The Bank of Albania decreased its main monetary policy interest rate by 25 basis points to 5.00% from 5.25% previously. Bank of Albania Governor, Adrian Fullani, said: "The Supervisory Council decided to decrease the basic interest rate by 0.25 percent, by making its value 5 percent. This serves the achievement of the inflation's objective in middle-term periods and at the same time it offers the necessary monetary conditions to stimulate economic activities in the country. I believe that this measure will be transmitted at the defined level,"

Central Banking After the Crisis (Research Review)

The Bank for International Settlements (BIS) released an interesting piece of research entitled 'Central Banking post-crisis: What compass for uncharted waters?' by Claudio Borio The essay covers the challenges emerging from the crisis that central banks must face, these challenges are economic, intellectual, and institutional. The essay provides a "compass" for central banks to use in thinking about the challenges presented by the crisis, and more importantly the post-crisis environment. "The compass is based on tighter integration of the monetary and financial stability functions, keener awareness of the global dimensions of those tasks, and stronger safeguards for an increasingly vulnerable central bank operational independence."

Subscribe to:

Posts (Atom)